BRANDED ARTISTS

ART MARKET

LEADERS OF THE ART WORLD

SPONSORING

ART SPONSORS

INVESTING IN ART INSTITUTIONS

BEST ADVISORS

Georgina Adam, Art's Unflinching Observer

Few voices have proven as vital, or as incisive, as Georgina Adam in an art world where the value of a painting can rise faster than tech stocks and private collectors move with the force of investment bankers. Based in London, Adam stands as one of the preeminent chroniclers of the global art market, a rare commentator capable of cutting through the fog of speculation and hype to reveal the mechanics of an industry that often prefers to remain in shadow.

With decades of experience writing for The Art Newspaper and the Financial Times, Adam has built a reputation for intellectual rigor, clarity of style, and a quietly formidable skepticism. Her work does more than report on record-breaking auction results or blue-chip gallery openings; it interrogates how the art world functions, who benefits, and what’s left unseen beneath the surface.

From Journalism to Authority

Georgina Adam’s authority in the field stems not only from her long career in arts journalism but also from her commitment to viewing art through the lens of economics, policy, and globalization. She rose as a prominent voice in the industry during the 1990s and early 2000s, when the art market was transforming from a niche cultural sector into a global asset class. As the tentacles of finance reached deeper into art, Adam chronicled these shifts with a sense of urgency and skepticism.

Her columns for the Financial Times’ Collecting section became required reading for those navigating the increasingly complex art ecosystem. There, she provided clear, digestible explanations of arcane tax loopholes, legal battles, and the opaque structures behind art fairs, freeports, and advisory firms. Her audience spans seasoned collectors, curators, and artists, as well as those looking to understand why a $70 million painting might end up in a Geneva storage facility, unseen for decades.

Big Bucks and the New Art Economy

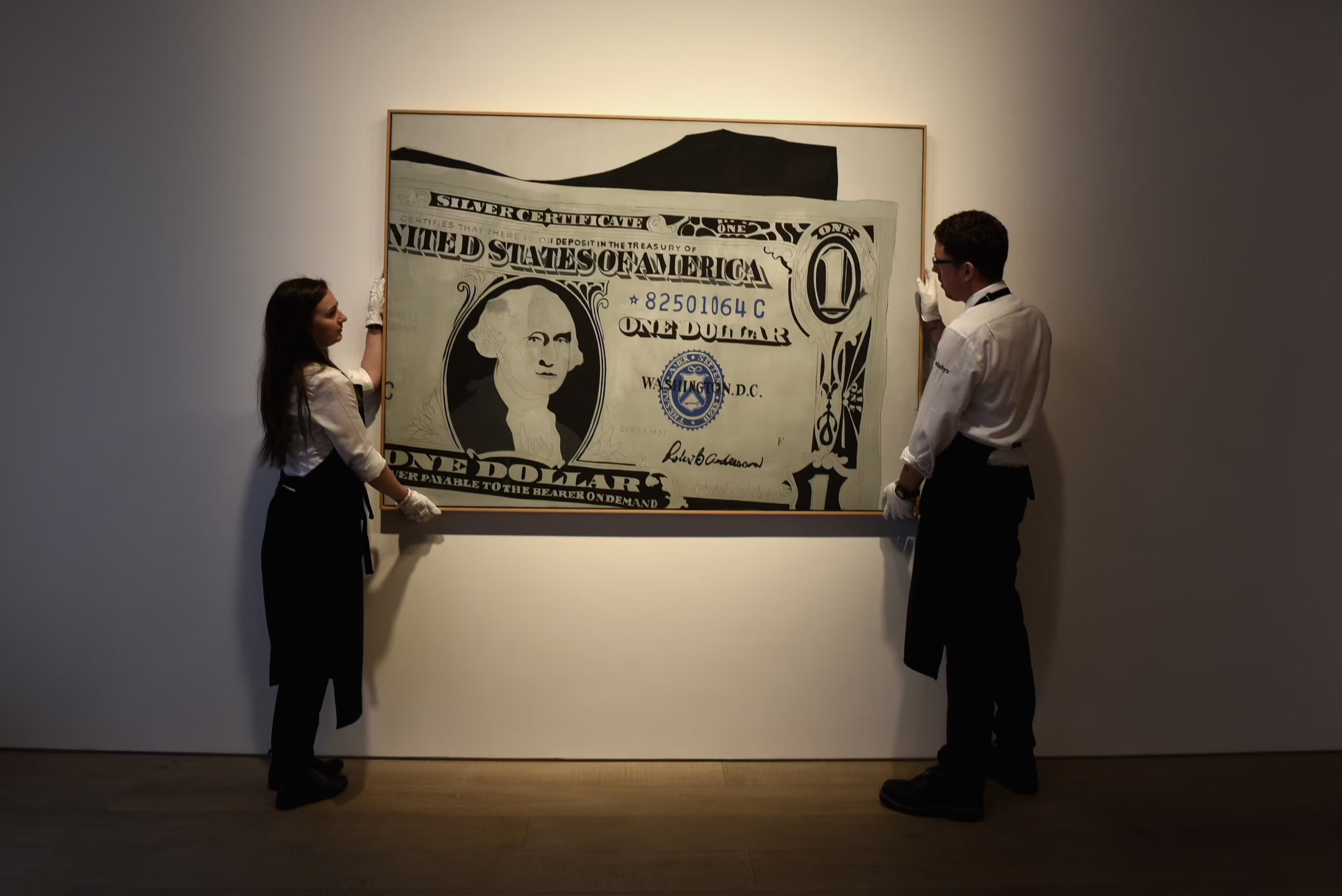

In 2014, Adam published Big Bucks: The Explosion of the Art Market in the 21st Century (Lund Humphries), a book that crystallized her growing concern with the rapid monetization of art. Drawing on interviews, data, and years of reportage, Adam examined the high-octane art boom that followed the dot-com bubble and culminated in art’s firm integration into the worlds of wealth management and financial speculation.

“Art is no longer just about passion,” she wrote. “It is about capital, cachet, and control.” Big Bucks didn’t just chronicle market highs, it also asked uncomfortable questions about what happens when aesthetics are dictated by algorithms, and when taste is outsourced to advisors.

The book struck a chord across disciplines. It was praised for its lucidity by financial journalists, cited in university courses on cultural economics, and read by gallerists and auction house insiders alike. More than a market report, it was a cultural analysis of how art was being remade, often invisibly, by the pressures of globalization, deregulation, and wealth concentration.

Dark Side of the Boom: Lifting the Veil

Adam’s 2018 follow-up, Dark Side of the Boom: The Excesses of the Art Market in the 21st Century, took a more critical turn. If Big Bucks was an anatomy, Dark Side was a diagnosis.

The book laid bare the ways in which the market’s growth had fostered unethical practices: price manipulation, conflicts of interest, money laundering, and artist exploitation. Adam traced the dubious provenance trails that led from auction floors to offshore entities, revealing how a lack of regulation enabled the use of art as a vehicle for wealth concealment.

The book’s impact was significant. At a time when global headlines were covering the Paradise Papers and government crackdowns on financial secrecy, Dark Side of the Boom became a vital companion piece. Adam was featured in panels and interviews across Europe and North America, offering her voice as a measured but insistent critic of a system built, at times, on opacity and excess.

Yet her tone was never moralistic. Adam is more analyst than activist, she invites readers to understand before judging. In this, her work has been compared to that of economic sociologists like Saskia Sassen or Mariana Mazzucato: a bridging of art and systemic critique.

Educator and Conference Chair

Adam’s impact goes beyond the page. As a lecturer at Sotheby’s Institute of Art in London, she brings her insights directly to emerging professionals in the field. Her classes are known for their clear-eyed approach to market dynamics, as well as for urging students to ask foundational questions: What constitutes value in art? Who gets to decide it? And what are the long-term implications of treating art as a speculative asset?

She also serves as Chair of the Art Business Conference, an annual forum that convenes leading voices from galleries, auction houses, legal firms, and tech startups. Under Adam’s stewardship, the conference has grown into one of the art world's premier think tanks, part networking hub, part ethical watchdog. The topics she helps program, blockchain’s potential and perils, climate sustainability in shipping, the future of authentication, speak to her ongoing relevance in a rapidly evolving field.

In recent years, Adam has also been active in platforms that elevate women in the arts. She is featured on womenartdealers.org, a network that promotes equity and visibility for women-led galleries and advisory firms. Her advocacy is subtle but consistent, part of a broader ethic that sees transparency and inclusion as crucial to the market’s long-term health.

A Voice of Clarity in a Clouded Field

To understand Georgina Adam’s contribution is to understand how rare clarity is in the art market. The ecosystem she analyzes thrives on ambiguity: anonymous buyers, complex pricing, and vast disparities in access. In this context, her writing feels almost radical in its insistence on facts, definitions, and traceability.

She remains skeptical of the “financialization” of art, warning against over-reliance on metrics and indexes. Yet she is not anti-market. Her perspective is nuanced, one that appreciates the dynamics of collecting, the cultural capital of ownership, and the thrill of connoisseurship, so long as they don’t overshadow the intrinsic value of art itself.

Adam is also refreshingly immune to trends. While NFTs surged and cooled, she examined their legal and archival consequences. When megagalleries launched artist estate management arms, she asked who benefits from such vertical integration. And when younger collectors began moving away from legacy fairs, she explored how Instagram and private viewing rooms were rewriting the rules of engagement.

Her audience remains broad: from hedge fund managers to MFA students, from skeptical academics to auction house insiders. Few commentators have earned such trust across such a diverse readership.

The Future of Art, and Its Chronicler

As the art world continues to grapple with post-pandemic shifts, geopolitical tensions, and climate concerns, the role of the analyst has never been more crucial. Georgina Adam occupies this role with a steady hand and an uncompromising gaze. Her work reminds readers that art, however beautiful or transcendent, exists within structures, economic, legal, historical, that deserve scrutiny.

What distinguishes Adam is not just her mastery of data or her access to industry players. It’s her commitment to literacy, cultural, financial, and ethical. She writes so that readers can be better participants in the art world, whether as buyers, makers, scholars, or critics.

In an age of influencer taste and speculative hype, Georgina Adam’s contribution is a rare and necessary counterbalance: an insistence that we not only look at art, but also look behind it.

ART MARKETING

RECOMMENDED READS

OPINIONS

The Economics of Sculpture in the 21st Century

The Multifaceted Nature of the Sculptor's Profession

The world of sculpture is a fascinating universe where raw matter is transformed into expressive forms through vision and craftsmanship. However, beyond artistic creation, there exists a complex economic reality that significantly shapes the lives and work of sculptors. The profession inevitably navigates the tension between realizing artistic visions and the necessity of securing a livelihood, often challenging artists to combine creative integrity with entrepreneurial skill. While it is a common assumption that artists, including sculptors, frequently face financial uncertainties, experience shows that paths to stable income do exist, though they often demand a high degree of entrepreneurial spirit.

The initial intention behind creation, whether it's purely for sustenance by adapting to market demands or artistic expression requiring alternative financing strategies, can decisively influence a sculptor's path. To succeed in this demanding field, a profound understanding of the "business side" is essential, encompassing networking, building an online presence, and solid financial knowledge. This article illuminates the diverse income sources and specific challenges sculptors face, from direct sales and commissions to collaborations with galleries, realizing public art, the significance of grants, institutional support, and the tangible aspects of material procurement and logistics.

The traditional image of the "starving artist" contrasts with the reality of the modern sculptor, who must increasingly act as an entrepreneur. It's no longer just about selling art but also about branding, strategic networking, and financial planning. The notion that most artists don't earn much money correlates with the need to run a business, become familiar with tools, build contacts, and understand tax regulations. This points to a discrepancy: the romantic idea of pure artistic creation versus the modern requirement to also be a businessperson. This creates an inherent tension, as artists must dedicate time to non-artistic tasks to sustain their artistic practice, potentially necessitating adjustments in art education and support systems to impart more entrepreneurial skills.

A sculptor's primary motivation, whether predominantly commercially oriented or focused on artistic expression with financial necessities, fundamentally shapes their income strategies and market participation. An artist primarily aiming to earn money might focus on popular, easily sellable works or establish their art as a brand with a business model. Conversely, artists prioritizing artistic integrity will seek diverse ways to finance it, such as through grants or teaching positions. This implies the "art market" is not monolithic; different segments serve varied artistic intentions and financial goals, which in turn can influence collector perception and long-term artistic reputation. A purely market-oriented production might yield quicker sales but potentially less critical acclaim or museum interest than a more artistically ambitious, albeit financially challenging, path.

The Foundations of Income: From Direct Sales to Teaching

Sculptors draw on a wide array of income sources to finance their artistic activities and livelihood, ranging from traditional sales models to innovative digital strategies and knowledge dissemination.

Studio Sales, Online Presence, and Digital Marketplaces

Direct sales from the studio remain an important, though often irregular, source of income. To boost these sales and reach a broader audience, establishing a strong online presence is crucial. This includes a professional website and active profiles on social media like Instagram or platforms such as Behance. Such digital showcases allow potential buyers to discover the artist's work and make direct contact.

Specialized online marketplaces like Etsy, Saatchi Art, Artfinder, and Artsy offer sculptors global sales platforms. Saatchi Art, for example, provides access to a large international audience and handles marketing and payment processing, but charges a 40% commission on the sale price. Success factors on these platforms include high-quality photographs of the works and active self-promotion. E-commerce in the art sector is continually evolving, with platforms increasingly implementing "buy now" options to simplify online art purchases. However, challenges include high competition and the need for effective search engine optimization (SEO) and digital marketing. The digitalization of the art market, while offering unprecedented global reach, also imposes significant demands, pushing sculptors further towards becoming digital entrepreneurs. Investing time and potentially money in digital marketing, SEO, and content creation can divert resources from actual artistic work, potentially favoring artists skilled in personal branding and online engagement.

Commissioned Works: Private and Public

Commissions are a significant income source. Private commissions often arise from networking, social media presence, or direct inquiries. Detailed contracts are essential, covering aspects like scope, payment, copyrights, and installation. For monumental works, intensive discussions on design, size, material, and budget are necessary. Public commissions, discussed later in detail, are also a fundamental, albeit challenging, income stream that can have a substantial impact.

The Role of Editions and Limited Series

Producing limited editions, especially with materials like bronze or resin, allows sculptors to sell multiple copies of a work, often at more accessible prices than unique pieces. Smaller editions (e.g., five to ten pieces) tend to be more valuable due to their rarity and exclusivity. The value of an edition is influenced by factors such as the artist's reputation, material, condition, signature, authentication, and current market trends. Foundries like Foundry Michelangelo specialize in producing bronze editions. Offering editions democratizes access to sculpture but also risks potential devaluation if edition size and quality are not carefully managed, underscoring the need for entrepreneurial thinking.

Licensing, Teaching, and Workshops as Income Pillars

Besides direct sales, sculptors tap into other revenue streams. Licensing designs for products like merchandise or prints allows artists to earn royalties while retaining copyright, requiring a clear portfolio, market understanding, and IP protection; art licensing agents can assist.

Teaching, whether through online courses or in-person workshops, provides a steady income and facilitates community exchange, leveraging the artist's expertise beyond mere sales.

Other diversified income opportunities include freelance activities, selling digital art and prints, NFTs (market volatility notwithstanding), and Patreon services. The prevalence of smaller income streams suggests that a "portfolio career" combining diverse activities is the norm for many sculptors. This offers financial stability but demands significant time management and varied skills. Juggling these roles can impact artistic production. Support systems should acknowledge this model.

The Gallery Market: A Partnership with Opportunities and Pitfalls

Galleries traditionally play a central role in the art market and can be vital partners for sculptors seeking visibility and sales success. However, collaboration is often complex, requiring a clear understanding of mechanisms and contractual terms.

Functioning of Gallery Representation and Typical Contract Models

Galleries act as intermediaries, marketing, exhibiting, and selling an artist's works, typically on a consignment basis. Traditional gallery representation often involves an exclusive contract. However, these models are evolving to include project-based collaborations or agency support. A good, trusting relationship with the gallery is crucial for long-term success. While traditional exclusive gallery representation remains prestigious, the rise of alternative models and artists' ability to sell directly online suggest a potential power shift, possibly giving artists more negotiating leverage.

Commission Rates and Their Implications

Gallery commissions typically range from 30% to 50% of the artwork's sale price, with 50% being common to cover operational costs. This significantly impacts the artist's net earnings and must be factored into pricing. To avoid undercutting gallery partners, artists should price their works consistently across all channels. Artists must also be aware of other potential deductions (e.g., transport, specific marketing expenses), which must be explicitly agreed upon in the contract.

Negotiation Points: Transport, Installation, Insurance of Large Works

Gallery contracts should clearly define responsibilities for insurance (gallery should insure works at full retail value), transport costs, and installation. For sculptors, specific clauses for handling large/heavy works, installation costs, and insurance for unique or delicate materials are vital. Contracts stipulate artist responsibilities for fabrication, transport, and installation. Exclusivity clauses and payment terms should also be set. Consistent pricing not only maintains good gallery relations but also establishes a credible market value and fosters collector trust.

Art in Public Spaces: Visibility, Impact, and Funding

Public art offers sculptors a platform for extensive visibility and the opportunity to actively shape urban or landscape environments. However, securing such commissions is often complex, and funding models are diverse.

The Path to Public Art: RFQs/RFPs and Selection Processes

Public art projects are typically awarded through competitive processes, often starting with a "Call for Artists" as a Request for Qualifications (RFQ) or Request for Proposals (RFP). An RFQ asks for qualifications, an RFP for a detailed project proposal. Selection committees evaluate submissions. The process can be lengthy, involving multiple stages, including presentations and maquettes (for which artists should be compensated). Organizations like Americans for the Arts and CODAworx offer resources. Realizing a public art project demands not only artistic excellence but also strong non-artistic skills (proposal writing, budgeting, project management) and can significantly boost reputation but also carries risks like budget overruns.

Funding Models: "Percent for Art," Foundations, Private Investors

A common funding model is "Percent for Art," where a percentage (usually 0.5%-2%) of public construction project budgets is reserved for art. Other funds come from public-private partnerships, direct state allocations, developer contributions, hotel/motel taxes, sales tax portions, and grants from foundations like the National Endowment for the Arts (NEA). Special Public Art Trust Funds may be established. While "Percent for Art" programs provide dedicated funding, their dependence on capital investment projects means funding can be cyclical and tied to economic development.

Long-Term Effects on the Artist's Reputation and Income

Public art commissions can significantly enhance an artist's reputation and visibility, demonstrating the ability to manage large-scale projects. Direct income comes from the commission fee. The increased reputation can lead to further commissions and an appreciation in the value of other works. Case studies show such programs can lead to increased financial stability. CODAworx reports highlight the economic power of public art. Challenges include long project durations and public scrutiny. Successful public art transforms places, fosters community identity, and elevates an artist's standing; this reputational capital can be more valuable long-term than the fee.

Collectors and Institutions: The Driving Forces of the Market

Private collectors and public institutions like museums and foundations are crucial players in the sculpture market, influencing not only sculptors' financial situations but also their reputation and career development.

The Private Collector: Motivations, Relationship Building, and Trends

Private collectors' motivations are diverse: financial aspects (asset, inflation hedge), passion, emotional connection, exclusivity, status, cultural responsibility, and legacy. Psychological traits can shape collecting behavior. Building relationships with collectors involves online presence, art fairs, gallery events, gallerist introductions, personalized approaches, and sharing one's story. Long-term relationships are based on regular communication and personal attention.

Current trends show collectors increasingly buying art online, interested in emerging art and works under $5,000, and demanding greater price transparency. In sculpture, abstract and minimalist forms, technology integration, sustainable materials, and site-specific/interactive installations are in demand. The rise of younger, digitally savvy collectors is changing interaction and requiring more open communication and accessible pricing.

The Role of Museums and Foundations: Acquisitions, Exhibitions, and Grants

Museum acquisitions significantly boost an artist's market value and reputation through institutional validation. The acquisition process is formal. Solo exhibitions in renowned museums are career milestones. Museums also support artists through lectures and workshops.

Institutions and foundations award grants and prizes (e.g., Pollock-Krasner Foundation, Creative Capital) and accolades, offering financial support and recognition. While museum acquisitions and exhibitions are powerful validators, the selection process can be opaque, influenced by internal policies and market trends, creating a feedback loop.

Grants and Residency Programs as Career Springboards

Residency programs (e.g., Sculpture Space) provide studios, stipends, and opportunities to create new work, network, and gain visibility, often culminating in exhibitions and adding credibility. Beyond financial relief, grants and residencies act as crucial validation points and networking opportunities, building an artist's CV and perceived legitimacy.

Matter and Logistics: The Tangible Realities of Sculpture

Material choice and logistical management are fundamental to sculptural practice, significantly impacting artistic statement and economic calculation.

Material Choice: Cost, Processing, and Durability

Sculptors use a wide range of materials: traditional (stone, wood, metal, clay) and contemporary (resins, plastics, 3D-printed materials, recycled objects).

- Bronze: Known for high durability and detail reproduction. Costs are high (copper/tin prices, lost-wax casting, finishing). Life-size statues: from $3,500 to >$50,000.

- Stone (Marble, Granite): Very durable, but high costs for quarrying, processing, and transport. Marble carving is time-consuming. Natural stone market 2024: $40.4 billion.

- Steel: Durable and versatile. Sourcing can be challenging (price fluctuations, supply chains). Processing involves welding and polishing.

- Wood: High labor costs for carving, inconsistent availability, and fluctuating costs for raw material.

- Ceramic: Raw material costs (clays, glazes) can be 30-40% of production costs. Kiln firing incurs energy and maintenance costs.

- Resin/Plastic/3D Printing: Resin allows fine details; materials/equipment can be pricier than filament 3D printing. PLA is cheap but brittle. CNC milling is used for large-scale projects.

Studio requirements and specialized equipment vary by material. The significant differences in material costs, durability, and processing complexity mean material choice profoundly influences production costs, pricing strategy, and market, making it a fundamental business decision.

Comparative Analysis of Common Sculpture Materials

| Material | Estimated Raw Material Cost | Processing Complexity/Cost | Durability (Indoor/Outdoor, Lifespan) | Key Sourcing Challenges | Typical Maintenance Needs |

| Bronze | High | High (lost-wax casting, chasing, patination) | Very high (Outdoor >30 years) | Cost of copper/tin, specialized foundries | Annual cleaning, waxing |

| Marble/Granite | Medium to High | High (carving, grinding, polishing) | Very high (Outdoor, very durable) | Weight, transport, stone quality | Low, periodic cleaning |

| Steel (Stainless) | Medium | Medium to High (welding, grinding, polishing) | High (Outdoor, corrosion-resistant for stainless) | Price fluctuations, supply chains | Low, cleaning |

| Wood | Low to High | Medium to High (carving, finishing) | Medium (Outdoor only with protective treatment) | Quality, drying, availability | Regular treatment (oils, varnishes) outdoors |

| Ceramic | Low to Medium | Medium (forming, firing, glazing) | Medium (Outdoor if frost-proof fired) | Specialized clays/glazes, kiln capacity | Cleaning, protection from frost damage |

| Resin/3D Print | Low to Medium | Low to Medium (casting, printing, finishing) | Variable (UV resistance, brittleness) | Quality of resins/filaments, print size | Depends on specific material, possibly UV protection |

Logistical Challenges: Transport and Installation of Monumental Sculptures

Transporting large, heavy sculptures requires specialized handling, custom packaging, climate-controlled vehicles, and lifting equipment. Sculptures should be disassembled if possible. Logistics include permits, foundation work, and close coordination. Companies like Artifact Logistics specialize in art logistics. International transport involves complex customs procedures and special insurance. EU import regulations for cultural goods are becoming stricter. Beyond visible costs, monumental sculptures incur significant "hidden" costs in logistics, installation, and insurance, requiring expert management.

Insurance Aspects for Artworks and Artist Liability

Sculptors need general liability insurance. Artwork insurance (especially "wall-to-wall" coverage) during transport and consignment is essential. Galleries should insure works at full retail value. Special art transport insurance is necessary for international shipments. For many sculptors, foundries and specialized fabricators are indispensable partners; costs for their services are a major part of production costs and must be carefully negotiated and contracted.

Global Perspectives and Market Trends

The sculpture market is dynamic, shaped by evolving collector preferences, technological innovations, and global trade flows. Understanding these trends is crucial for sculptors to position themselves successfully.

Current Collector Trends: In-Demand Styles, Themes, and Materials

Styles and themes show growing interest in abstract and minimalist forms, geometric sculptures, and conceptual works. Figurative sculptures remain relevant. Themes like cultural fusion, identity, and social issues are prominent. Site-specific and interactive installations are gaining importance.

Material trends lean towards sustainable and unconventional materials. Traditional materials remain valued. Technology integration (3D modeling/printing, projection mapping, digital art/NFTs) is a key trend.

Collector behavior has changed: more selective, price-sensitive, demand more transparency. Strong interest in emerging artists and works under $5,000. Online purchases are increasing. Young collector generations are an increasingly important market force. The sculpture market shows a dichotomy: growing demand for accessible art and a high-end market. Sculptors must strategically position themselves.

The International Sculpture Market: Key Centers, Fairs, and Auction Houses

The global art market is substantial. Total art sales 2024: $57.5 billion. The "art and sculpture market" was valued at $42.998 billion in 2023, with projected growth. Sculptures account for about 9% of global art sales.

Key centers: US (45%), UK (18%), China (17%). North America and Europe dominate the public space sculpture market, Asia-Pacific shows growth potential. Leading US cities for bronze foundries are in Arizona, California, Colorado, New York, New Mexico.

Art fairs are crucial (31% of dealer revenues 2024). Major fairs like Art Basel and TEFAF influence trends and careers.

Auction houses like Christie's, Sotheby's, Phillips are central. Auction revenues declined in 2024, private sales increased. Sell-through rates remained relatively high (84% 2024). Auctions show a shift towards historical artists.

Challenges and Opportunities in Global Trade: Customs, Cultural Adaptation

International sculpture trade is challenging. Sculptures (HSN code 9703) are often US duty-free. However, international shipping requires complex customs declarations and can face tariffs. New EU regulations (from June 2025) require import licenses for older cultural goods. China's import regulations are complex.

International sculptors must adapt works to cultural contexts (understanding local aesthetics, narratives). The digital age offers platforms for transcultural exchange but raises ethical questions. Logistics and insurance for international transport require specialists. Globalization offers reach but also hurdles in logistics, customs, and cultural adaptation, potentially favoring established artists.

The Entrepreneurial Dimension of Sculpture

The sculpture market is a complex ecosystem where artistic creation and economic necessities are inextricably linked. For 21st-century sculptors, navigating this market is as crucial as their craftsmanship and creative vision.

Sculptors' income structures are highly diversified, relying on direct sales, commissions, galleries, public art, licensing, teaching, grants. Success depends on entrepreneurial skills: networking, marketing (especially digital), financial planning, contract negotiation, market understanding. The sculptor today often acts as the "CEO of their own enterprise."

The modern sculptor must navigate a hybrid art world, blending traditional skills with digital competence and business acumen, redefining the artist's role to cultural entrepreneur. This is reflected in the need to manage brand, finances, and production. "Success" expands beyond critical acclaim to building a sustainable career, with implications for art education.

Looking ahead, the art market will continue to evolve. Digital platforms, new technologies (VR/AR, 3D printing), and changing collector demographics will shape conditions. Sustainability will also be influential. The tension between artistic integrity and commercial demands will require adaptability. The sculptor's role may feature more direct audience interaction and proactive career management.

Despite the rise of digital art, the physicality of sculpture, especially with traditional materials, offers a unique selling proposition. Challenges in material and logistics contribute to perceived value. The longevity and timelessness of these materials contrast with digital ephemerality. Sculptors working with traditional, tangible materials may find a resilient niche among collectors valuing permanence and craftsmanship. The "difficulty" of production becomes part of the value proposition. The sculptor's path is thus not only creative but also entrepreneurial.